does doordash report income to irs

Nonetheless at the end of the fiscal year it issues a. Doordash does not provide.

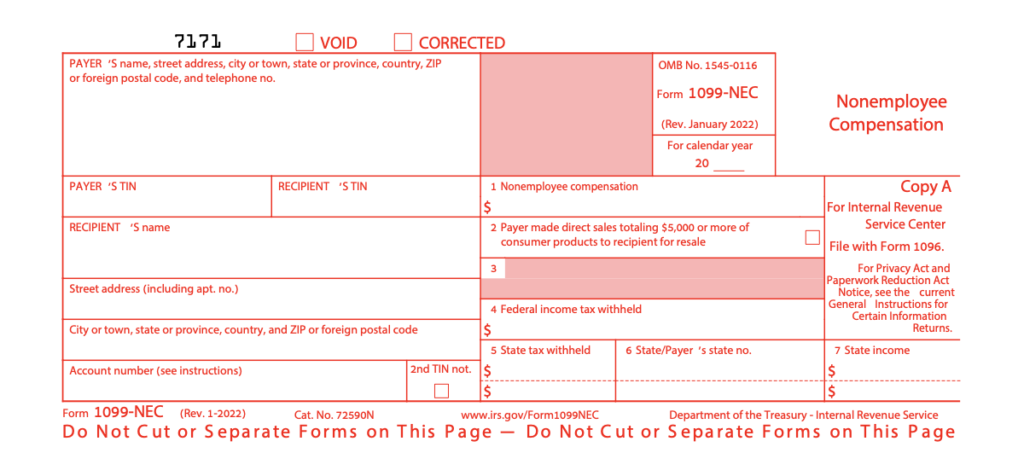

The New 1099 Nec Irs Form For Second Shooters Independent Contractors Formerly 1099 Misc Lin Pernille

Dashers not eligible for a 1099-NEC- Since you have earned less than 600 dashing in 2022 you will not receive a 1099 form from DoorDash.

. Expect to pay at least a 25 tax rate on your DoorDash income. How does DoorDash report to IRS. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC.

Yes - Cash and non-cash tips are both taxed by the IRS. Yes the payouts of this company are noted to an official unemployment branch but only if a certain amount is reached. However most companies reliant on non-employee contractors like.

Log into your checking account every pay day and put at least 25 of your dd earnings in savings. It will not report income from Dashers who earn less than 600. If you drove 500 miles all year thats another 26 off your taxes.

This is an UNOFFICIAL place for DoorDash Drivers to hang out and get to know one another. DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income. A DoorDash Merchant for example would receive a 1099-K from DoorDash as DoorDash has concluded it satisfies the criteria for a TPSO.

Federal income taxes apply to Doordash tips unless their total amounts are below 20. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms. In this way Does DoorDash.

DoorDash can be used as proof of income. DoorDash will send you a 1099 form at. Beginning with the 2020 tax year the IRS requires DoorDash to report Dasher income on the new Form 1099-NEC instead of Form 1099-MISC.

DoorDash will report the income of all its DoorDashers who earn more than 600 to the IRS. While DoorDash doesnt send its drivers W-2 tax forms it does send them 1099-NEC forms and reports drivers income to the IRS. This includes 153 in self-employment taxes for Social Security and Medicare.

DoorDash usually sends a 1099 to its drivers to keep track of their earnings to the IRS. Doordash considers delivery drivers to be independent contractors. You get to subtract 575 cents from your income or about 9 cents from your taxes for every mile you drove for DoorDash.

Since dashers are treated as business owners and employees they have. Your cash tips are not. At the end of every quarter add up your.

Keep in mind that DoorDash cannot provide. You do not get quarterly earnings reports from dd. According to the IRS independent contractors need to report and file their own taxes.

The seller would also need to meet the minimum. Companies like DoorDash are only required to issue this form if a contractor earned more than 600 in a given year. You should report your income immediately.

Yes - Cash and non-cash tips are both taxed by the IRS. It also includes your income.

The Best Guide To Doordash Driver Taxes In 2021 Everlance

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Irs Fumble Means Extra Tax Reporting For Businesses In More Than 30 States

Taxing The Gig Economy Congress Made An Improvement But More Reforms Are Needed

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Class Action Lawsuit Alleges That Drivers Are Paid Substandard Wages Top Class Actions

Loans For Doordash Drivers Almost Instant For Dashers

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

You Made 700 From An Online Side Hustle Now The Irs Will Know Wsj

Got Hidden Income The Irs May Get More Money To Find You Wsj

How Do Food Delivery Couriers Pay Taxes Get It Back

15 Must Know Doordash Driver Tips 2022 Make More As A Dasher

Does Doordash Track Mileage What Delivery Drivers Need To Know

Guide To 1099 Tax Forms For Doordash Dashers Stripe Help Support

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How To File And Take Care Of Your 1099 Doordash Taxes

Freelancers 4 Tax Forms You Ll Receive This Tax Season

Do I Have To Report Doordash Earnings For Taxes If I Made Less Than 600 On Their Platform Quora