south dakota excise tax on vehicles

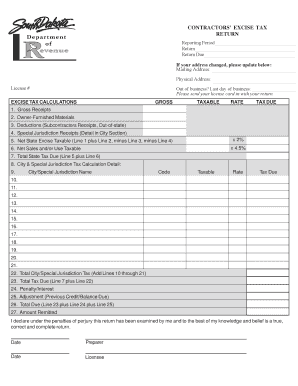

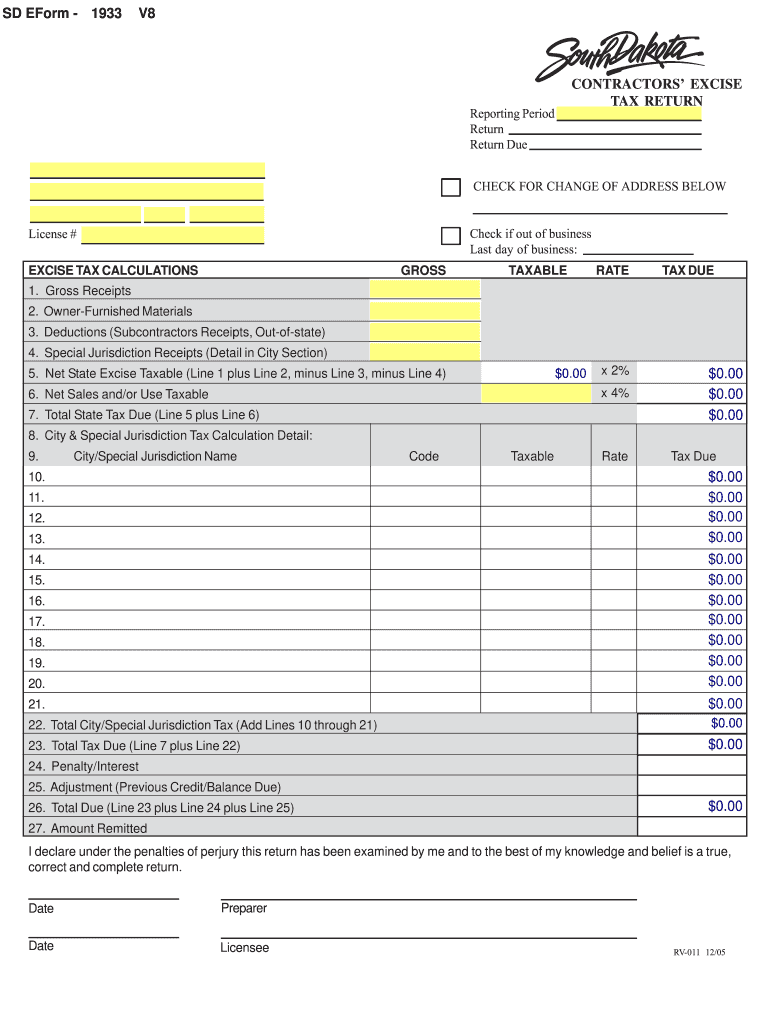

95-A title only is issued when the applicant does not purchase license plates or pay the 4 excise tax. See the contractors excise tax guide for more information about laws and regulations.

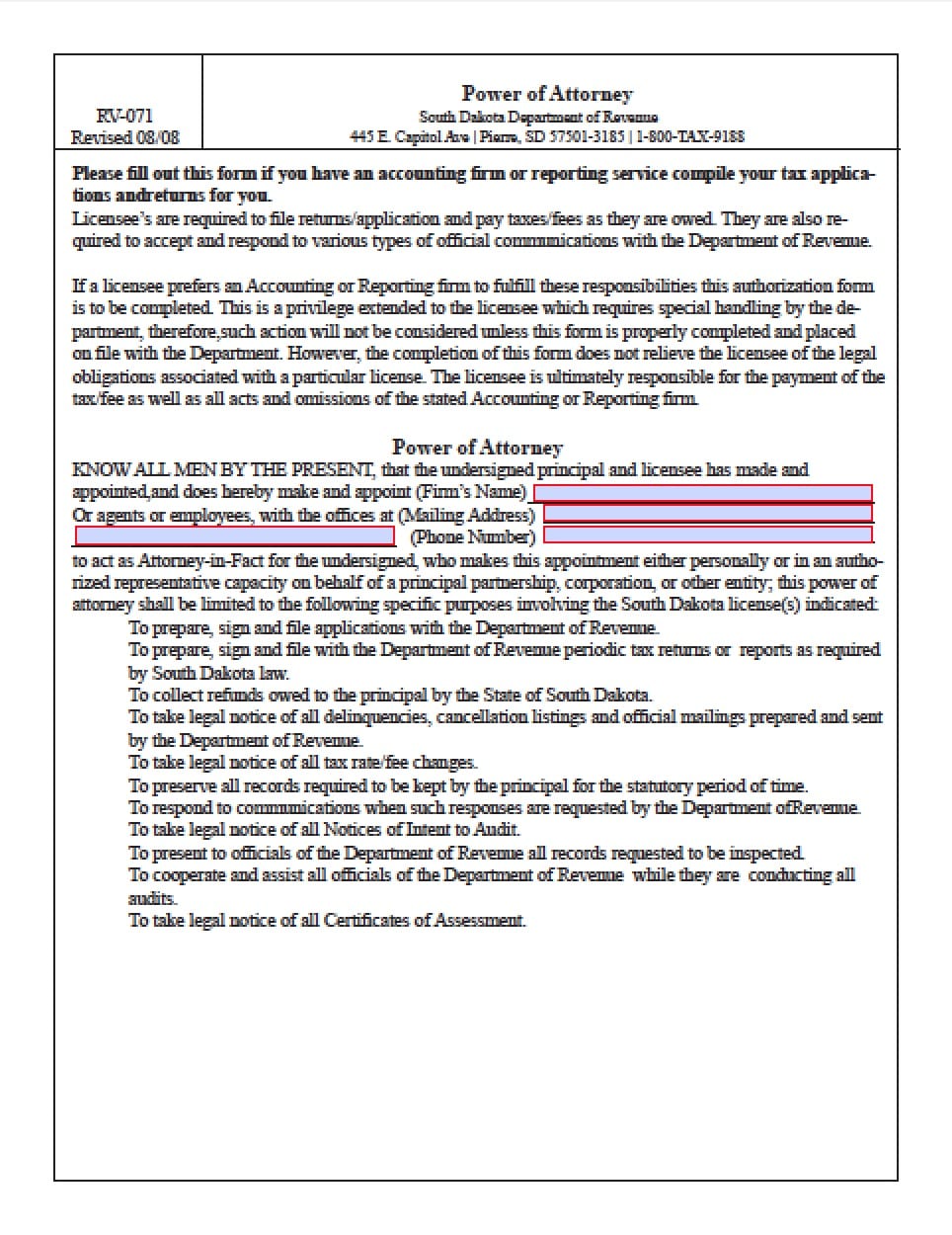

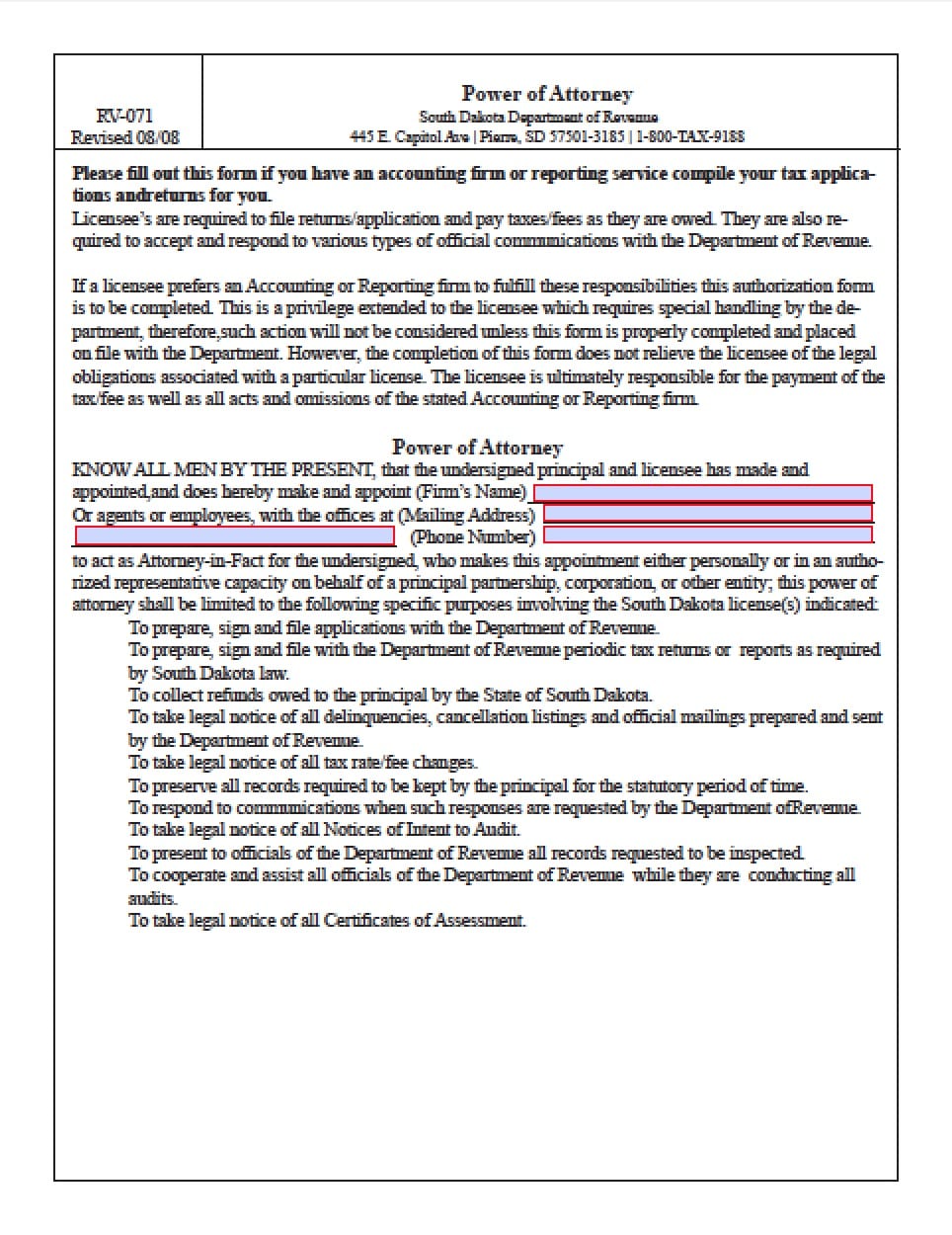

South Dakota Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

Its free to sign up and bid on jobs.

. In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and. 32-5B-14 - Licensing and payment of excise tax on new vehicle by dealer. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

Section 32-5B-14 - Licensing and payment of excise tax on new vehicle by dealer. They sell that is subject to sales tax in South Dakota. Therefore someone who makes 1000 from betting must pay an excise tax of 200 to the IRS.

South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. South Dakota collects a registration fee and a title fee on the sale or transfer of cars and motorcycles which are essentially renamed excise taxes. The purchaser requests and is.

Motorcycles cars pickups and vans that will be rented for 28 days or less. All motor vehicles including ATVUTV and motorcycles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax on the total purchase price. If I paid Excise tax on a new vehicle in South Dakota can I claim that as sales tax.

A person shall pay an excise tax at the rate of four percent on the purchase of an off-road vehicle as defined by 32-3-1 and required to be titled pursuant to 32-20-12. Contractors Excise Tax Laws Regulations. This report is a list of Business Tax delinquent taxpayers 2.

Section 32-5B-15 - Payment of excise tax by dealer required to take title-Subsequent purchaser not exempt. Motor vehicles not subject to motor vehicle excise tax include. 94-ATVs purchased prior to July 1 2016 are exempt from the 4 excise tax.

South Dakota doesnt have income tax so thats why Im using sales tax. Uses the product or service in a municipality that. Business Tax includes sales tax use.

If the excise tax is assessed on the retail value the value of the motor vehicle taken in as credit on trade-in shall be the retail value as stated in the nationally recognized dealers guide. The South Dakota Department of Revenue Pierre SD ITEMS OF NOTE. In addition for a car purchased in South Dakota there are other applicable fees including registration title and.

Any person entering into a contract for construction services as defined in Division C of the Standard Industrial Classification Manual of 1987 or engaging in services that include the. Motor vehicles are not subject to the motor vehicle excise tax if. South Dakota assesses the one-time 4 tax if you have not paid at least that much to another state on all vehicles EXCEPT a purchase of a vehicle over 11 years old for an amount less.

If another person makes a profit of 200 the person will pay 40 to the IRS as an excise tax. This tax shall be in lieu. Search for jobs related to South dakota excise tax on vehicles or hire on the worlds largest freelancing marketplace with 21m jobs.

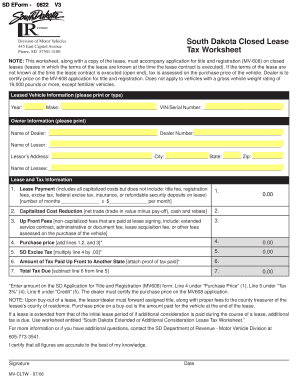

This form must accompany south dakotas application for title to qualify for credit against. That is subject to sales tax in South Dakota. If purchased in south dakota an atv is subject to the 4 motor vehicle excise tax.

32-5B-13 - Licensing and titling of used vehicle by dealer--Payment of tax by subsequent purchaser. Contractors Excise Tax Guide Laws Relating to. South Dakota Car Tax.

Car Rental Taxes Reforming Rental Car Excise Taxes

South Dakota Taxes Sd State Income Tax Calculator Community Tax

Will Moving To A State With No Income Tax Really Save You Money Student Loan Hero

What Is Excise Tax And How Does It Differ From Sales Tax

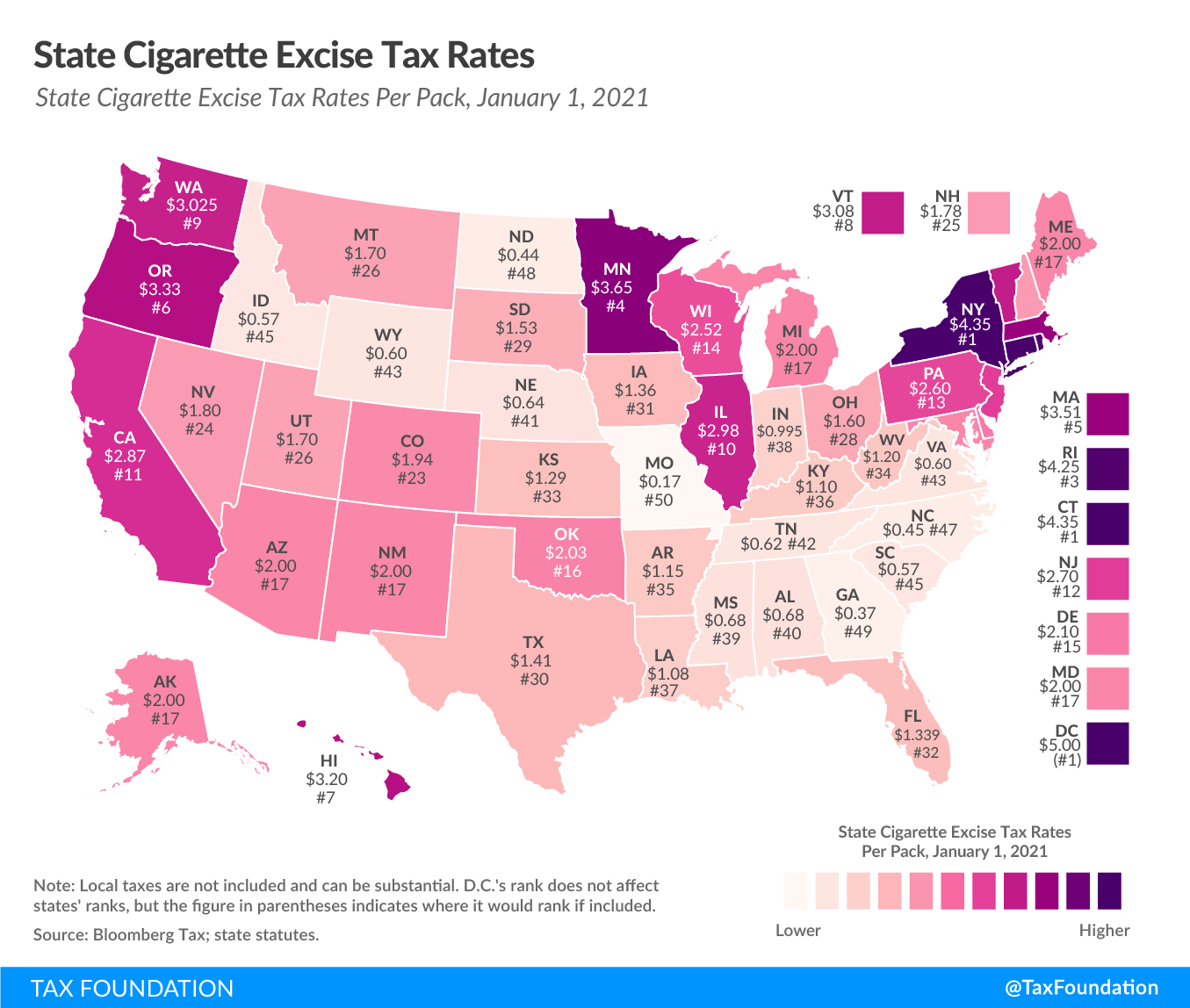

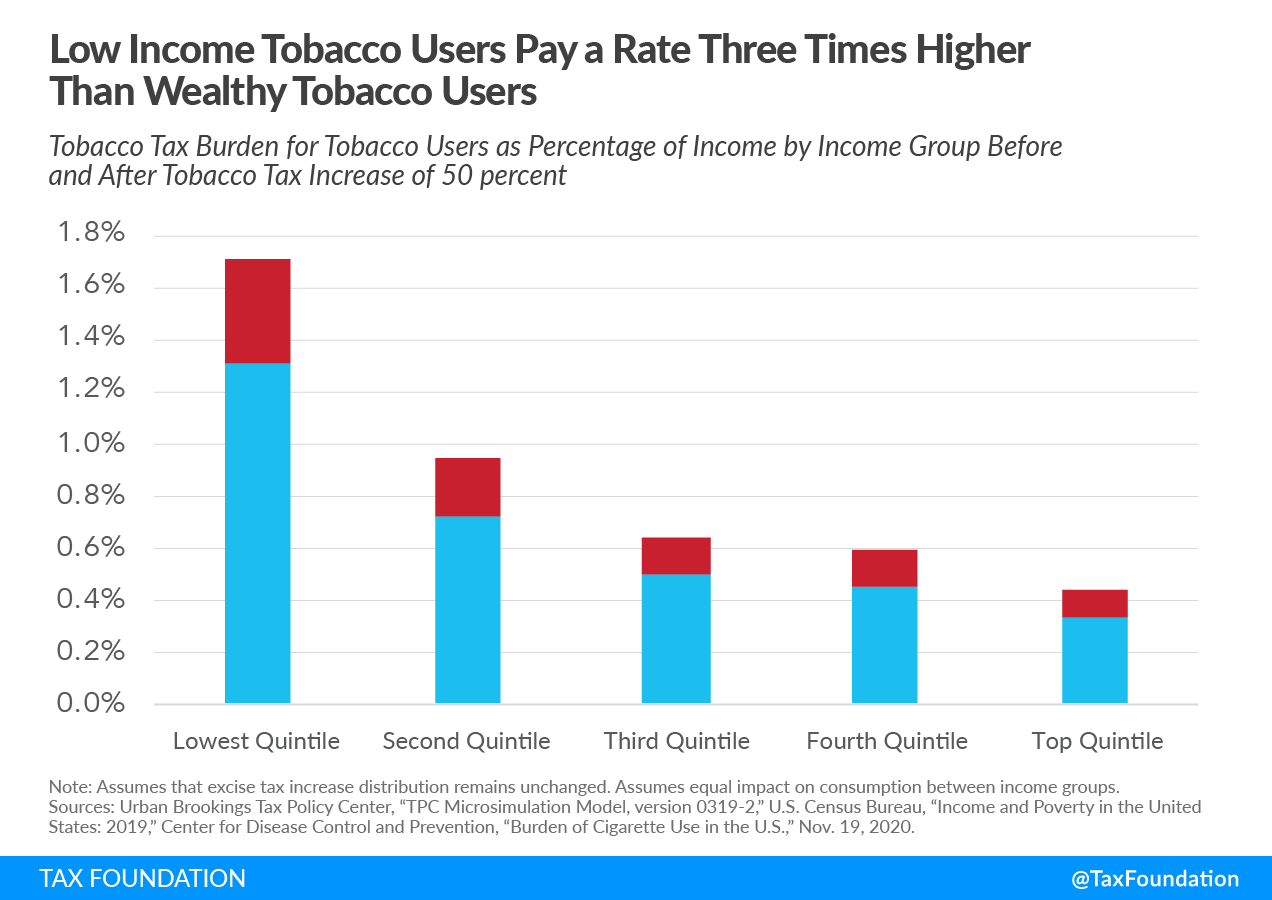

Excise Taxes Excise Tax Trends Tax Foundation

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online

South Dakota Vehicle Registration Vehicle Registration Services Dakotapost

South Dakota Lease Tax Worksheet Fill Online Printable Fillable Blank Pdffiller

Lithia Chrysler Dodge Jeep Ram Of Grand Forks Dodge Dealership In Grand Forks Nd

Car Rental Taxes Reforming Rental Car Excise Taxes

Excise Taxes Excise Tax Trends Tax Foundation

Motor Vehicle South Dakota Department Of Revenue

Excise Taxes Excise Tax Trends Tax Foundation

Contractors Excise Tax Webinar Youtube

Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd Fill Out Sign Online Dochub

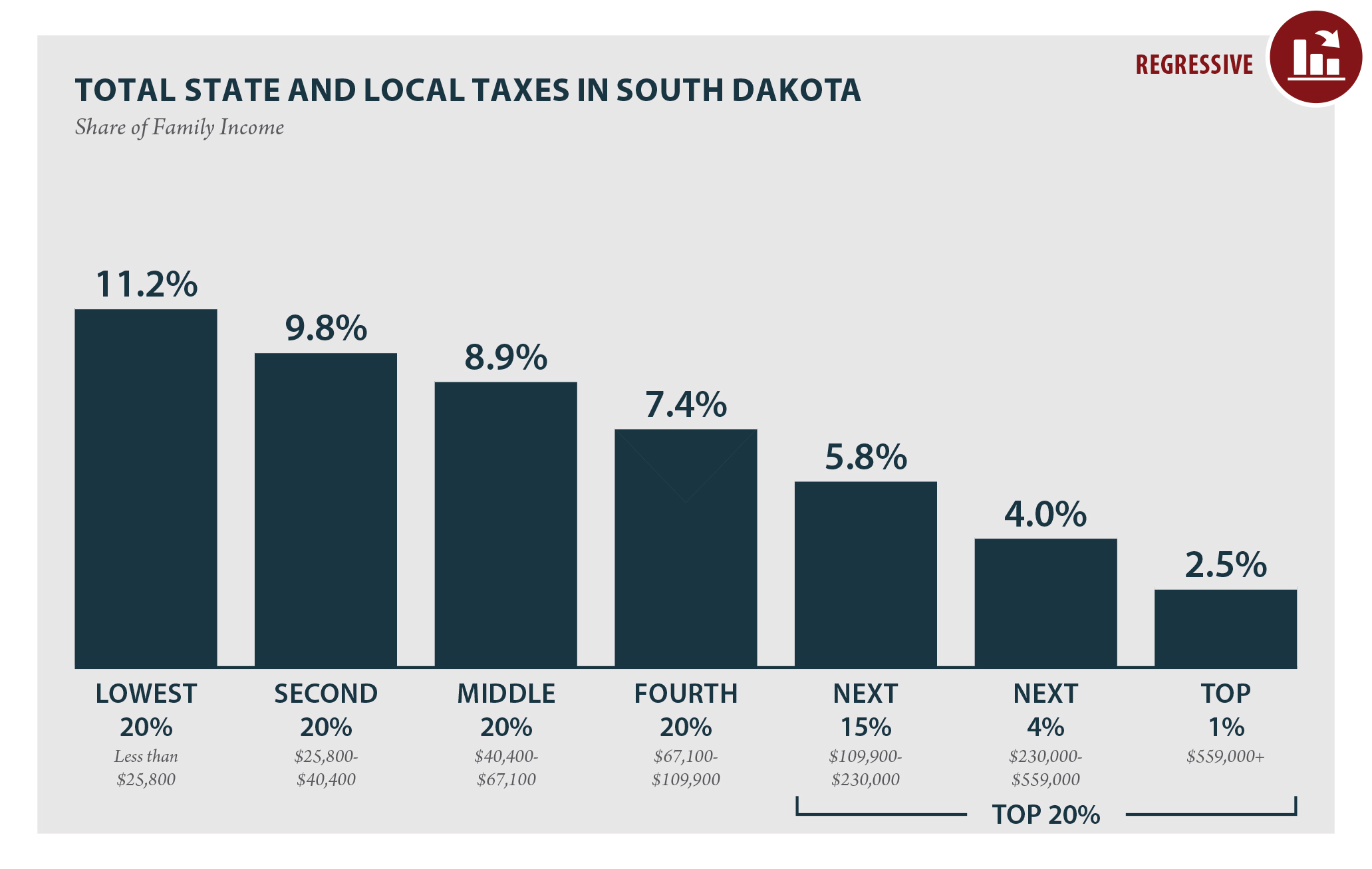

South Dakota Who Pays 6th Edition Itep

House Lawmakers Push Suspension Of Excise Tax Transport Topics